Danylo Hetmantsev, chairman of the Verkhovna Rada Committee on Finance, Taxation and Customs Policy, continues to talk about the discussion of goose-egging. Although in this case, we are talking about gander.

Pros in words According to Ms. Hetmantseva, the Ukrainian tax service received information from the Only Fans service about Ukrainian creators of paid content and the amount of income they received. As it turned out, Ukrainians are actively engaged in creating paid content on the platform, and the number of «accounts increases on average three times every year». This content is in high demand and generates high income. IT professionals who receive the highest average salariesThey will be jealous.

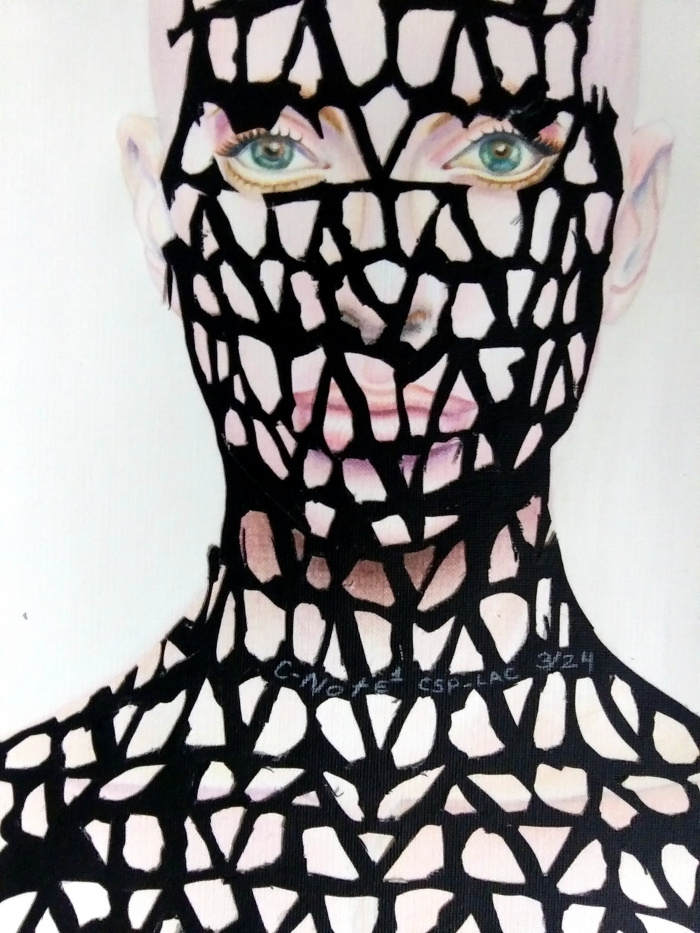

«For example, a citizen «C» received more than $4 million for creating paid content on the Internet platform «OnlyFans» over several years.

Also, a citizen of «K» received more than $3 million from the above activities, and a citizen of «B» received about $1.8 million»,” Hetmantsev says, worried about other people’s income.

Interestingly, the selective statistics of the head of the tax committee only mentions millionaires – not a single millionaire.

We can only be happy for our fellow citizens who manage to earn millions of dollars in difficult times for the economy during the war, using their own talents and strength, and without engaging in corrupt activities. At the same time, Danylo Hetmantsev reminds that foreign income must be declared and taxes paid on it.

«In accordance with the provisions of the Tax Code of Ukraine, a taxpayer receiving foreign income, i.e. income received from sources outside Ukraine, is obliged to file a tax return for the reporting tax year, declare such amounts with their respective taxation», ─ writes the tax and customs policy specialist.

Thus, Hetmantsev «strongly recommends» «fulfilling the tax obligation» ─ declaring income and paying taxes.

It should be added that the deadline for declaring income earned in 2023 has already passed. The relevant declaration had to be filed by May 1, 2024. The personal income tax indicated in the property tax return must be paid by August 1. Thus, the deadline has already passed. Therefore, all those who have not declared income from Only Fans will now have to pay a fine in addition to the taxes themselves. In this case, they will have to pay almost half of their income to the state and have an unpleasant experience with law enforcement agencies. It will probably not be possible to hide, because «the tax authorities have received information about Ukrainian citizens who create paid content on Only Fans».

«Failure to file a tax return within the statutory period is grounds for additional tax on the amount of income received at the rate of 18 percent and military duty at the rate of 1.5 percent, as well as 25 percent penalties.

“Not to mention the trouble of dealing with the BES,” warns Getmantsev.

He also adds that the obligation to pay taxes does not only apply to the income generated by Only Fans.

We would like to add that according to Article 301 of the Criminal Code of Ukraine, importation, manufacture, sale and distribution of pornographic items are illegal activities and are punishable by fines and imprisonment. At the same time, online broadcasting of porn is considered to be the manufacture with intent to sell and sale of pornographic video products.

Thus, Danylo Hetmantsev wants to collect taxes from a business that is actually illegal in Ukraine. Earlier in the interview, he spoke about the need to legalize porn, but as an MP, he failed to achieve this.

This post was originally published on this site be sure to check out more of their content.