As a freelance millennial with no savings, I have no retirement plan

December 4, 2024 7:00 am(Updated 7:25 am)

No one ever feels their age, do they? Ask anyone middle aged and over and they will say that they don’t feel any different from how they did in their twenties. Go to any care home in the world, and you will find scores of 90-year-olds who still feel 22 and are wondering who the hell that old person staring them back in the mirror is. It’s a universal experience. The problem is that we do age and keep ageing. The voice inside our heads may be barely out of its teens, but everything else is not.

This disconnect can lead to a lot of very foolish behaviour. Trying to drink like a teenager and then dealing with a hangover so bad you call the Samaritans would be a very good example. Thinking you can go trampolining with Gen Z work colleagues and ending up in A&E over the weekend with a dislocated knee is another one. And, of course, not planning for your inevitable retirement and old age.

I am an elder millennial, a generation born between 1981 and 1996, who are now largely in their thirties and forties. The generation of avocado toast and skinny jeans are now either in middle age or rapidly approaching it, with all the elegance of Ripley being dragged towards the airlock by the xenomorph queen in Aliens. And if the research is to be believed, we are not saving for what comes next.

According to Phoenix Group, the UK’s largest savings and retirement business, 59 per cent of UK millennials are struggling to save for retirement, the highest among all generations they surveyed. Apparently, only one in five of us think paying into a pension is a priority. I have to count myself among the 59 per cent who are struggling.

To be completely honest with you, as a freelance millennial with no savings, right now, my current retirement plan is selling pictures of my feet online. My only fear is the market demands will have shifted by then and the uptake for pictures of my wizened trotters will not be quite what I was hoping for.

I joke, of course. I have to! If I think seriously about what I am going to do without a pension safety net in place when I’m cruising towards 80, I am liable to induce a stroke so big I might not make it that far in the first place.

Common sense says that we should all be investing in our retirement plans. I know that, but is this even viable anymore? I grew up believing I would get a job for life, pay into a pension pot, and then retire comfortably to travel the world with a toy boy in my early-60s. But that dream has long since departed. For one thing, I won’t be able to access my state pension until I’m 67, and even that is projected to rise to 70 by the time I am in my sixties. Brilliant.

It’s not that I am unaware of just how important this all is, far from it. In fact, I was saving for a pension until very recently. For the last 15 years, I was employed as a senior lecturer in English and History at a UK university. I truly believed this would be a job for life and one I would retire from, but in recent years the rug has been well and truly pulled from underneath the UK higher education sector.

Reduced government funding, below inflation tuition fees and visa changes for international students have all come together to kick higher education in the teeth. Currently, there are some 85 UK universities that have opened up voluntary severance schemes or who are in the process of making redundancies. When my university opened a voluntary severance scheme, I decided to jump before I was pushed, abandoning my any further contributions to pension scheme in the process.

And I am far from my own in this situation. The dream of a comfortable retirement in your sixties now seems as unrealistic as trampolining with Gen Z. By the time you hit your forties, you would hope to be hitting the peak of your earning potential, but many millennials (just over half) are still living pay check to pay check, and changing jobs every few years. The housing crisis, cost of living crisis, stagnated wages, insecure employment contacts, and the lingering impact of Covid have really stuffed retirement plans up for a lot of us.

According to the research published by Phoenix Group, some millennials in full time employment have actually “decreased or stopped pension contributions entirely” in order to try and boost their income each month. It’s not a great idea, but you can hardly blame them. How can you save for a retirement when you are struggling to pay your rent?

In 2023, millennials made up 44 per cent of the rental market and a third of them expect to be renting their entire lives. I don’t actually recall a time in my adult life where the UK hasn’t been in the throws of some kind of financial crisis. So, it is completely understandable that so few of us have any kind of retirement plan in place. We can barely afford a midlife crisis, let alone old age!

I have been looking into private pension schemes but as I am just starting out as a freelancer, every penny of my income is precious, and I just can’t afford to pay into a pension right now. My hope is that this will change as I find my bearings and I can start making regular payments. Either that or the demand for photos of pensioner’s feet will dramatically increase and get me out of this mess.

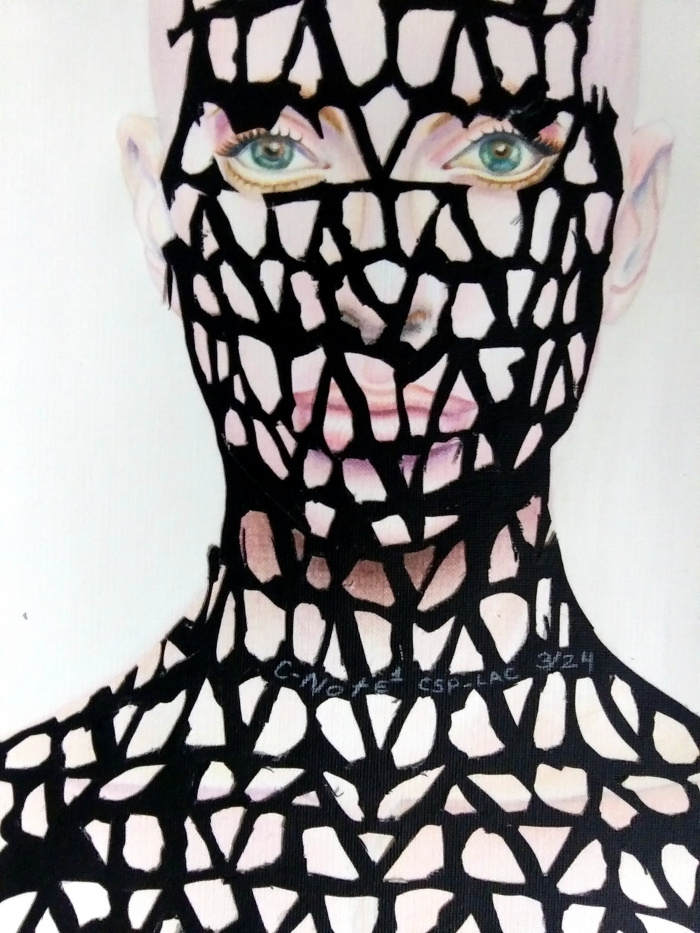

When I seriously think about the future, I honestly do not know what I am going to do. It is like a huge black, pension-less void hurtling towards me. This is only compounded by the fact I am single and self-employed with no steady income or employer to top up a pension for me. As much as I love being single and living alone, it comes at a very high price. I have no one to share the mortgage, utilities, or basic living costs. I pay for it all and that doesn’t leave much to play with each month. I hate to say it, but from where I am sat, retirement looks like a luxury.

The truth is that I don’t ever expect to be able to retire. I think I, and many others like me, will be working until the day we die, even if that is selling pictures of our feet online.

This post was originally published on this site be sure to check out more of their content.