Key Takeaways:

- OnlyFans eyes a potential sale valued at almost $8 billion, with a group of investors reportedly led by Forest Road Company initiating the talks.

- In 2023, OnlyFans processed $6.6 billion in payments, significantly higher than the $375 million it handled just three years earlier.

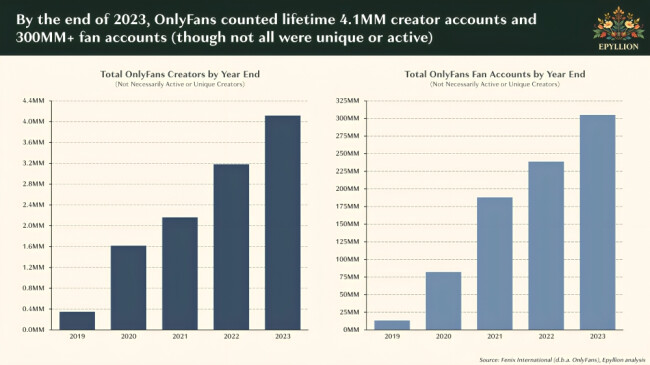

- The platform boasts over 4.1 million creators and 305 million users, reflecting its expansive reach in the creator economy.

OnlyFans, based in London and known for its subscription model, is considering a sale that could place its valuation close to $8 billion.

A group of investors, with involvement from Los Angeles-based investment firm Forest Road Company, is said to be driving the discussions.

Talks have been ongoing for months, and while a final agreement has not been announced, the interest proves the growing confidence in platform-driven business models.

OnlyFans has grown rapidly since the pandemic, reporting $6.6 billion in gross revenue processed in 2023, up sharply from $375 million in 2020.

With OnlyFans’ business back in the news, sharing some slides from my report on the company last year.

When considering OnlyFans revenues, profits, scale, defensibility, reach, and impact, the company is probably the most successful founded in the UK since DeepMind in 2010, the… pic.twitter.com/J2xX7rg3ou

— Matthew Ball (@ballmatthew) May 27, 2025

As of last year, its user base included more than 4 million content creators and over 300 million registered users.

OnlyFans generates revenue by retaining a portion of earnings generated through creator subscriptions, a model that continues to deliver strong returns.

Public filings show that Leonid Radvinsky, the company’s sole shareholder, has collected more than $1 billion in dividends over the last three years.

This reinforces the platform’s profitability despite reputational concerns.

This isn’t the first time an OnlyFans figure has pursued high-value tech ventures.

Earlier this year, OnlyFans founder Tim Stokely placed a final bid to acquire TikTok through his latest company, Zoop, in partnership with the HBAR Foundation.

That bid aimed to create a new platform focused on rewarding creators directly, signaling Stokely’s continued interest in content ownership.

ZOOP x HBAR x TIKTOK?!

OnlyFans founder Tim Stokely isn’t playing around.

His new company @zoopclub is bidding for TikTok powered by @HBAR_foundation.

Web2 collides with Web3 in a massive way.$HBAR about to go mainstream? pic.twitter.com/zWt5pG5Ft8

— Merlijn The Trader (@MerlijnTrader) April 8, 2025

Both developments point to the growing influence of platforms that prioritize creator revenue and user engagement over traditional ad models.

For agencies and strategists, it marks a clear evolution in how digital platforms generate value.

The Profit in Platform Risk

For firms like DesignRush, which help brands and agencies find the right digital partners, the OnlyFans story offers three sharp insights:

- Strong monetization models, especially those built on subscriptions, can deliver enormous enterprise value even when public perception is mixed.

- There is often a wide gap between a platform’s image and its underlying worth, something reputation consultants and marketing executives navigate regularly.

- Platforms that deal in controversial or sensitive content can still achieve major scale if they build strong infrastructure and take content safety seriously.

Agencies working with creator-driven brands should see this as a signal to reassess how content monetization, user engagement, and reputational risk interact.

Whether through ownership bids like TikTok’s or major exits like OnlyFans’, the next generation of platform value will be shaped not just by what users see but by how effectively those users and creators are paid.

As digital platforms evolve their monetization strategies, Netflix responded with a price hike earlier this year amid record growth.

Jermaine Dela Cruz is a reporter with over eight years of experience in journalism and marketing. She began her career as a business reporter before moving to corporate communications and digital marketing. Jermaine has developed expertise in editorial management, social media, SEO, and content publishing. She has worked with brands across various industries, including travel, SaaS, and telecommunications.

This post was originally published on this site be sure to check out more of their content.