One of the world’s top OnlyFans earners says she feels ripped off after being slapped with a tax bill of more than £200,000.

In the last half a decade, OnlyFans has boomed in popularity with pretty much everyone knowing what spicy purpose it is for.

Normal folk and celebrities alike have used the the platform to sell whatever they like. And we mean pretty much anything, including niche fetishes – just look at musician Lily Allen.

You can earn a fortune on the platform; although it’s not always guaranteed.

Some people also regret heading on there and revealing everything, so it’s definitely not a perfect move (what is, after all?).

Annie Knight is one of the top models on OnlyFans, with the adult content creator herself saying she is among the top 0.02 percent of earners on OF.

The 26-year-old makes a hell of a lot of money on the content platform. Towards the end of last year, she revealed she had been bringing in around $101,000 Australian dollars in just a month, which is roughly £52,770.

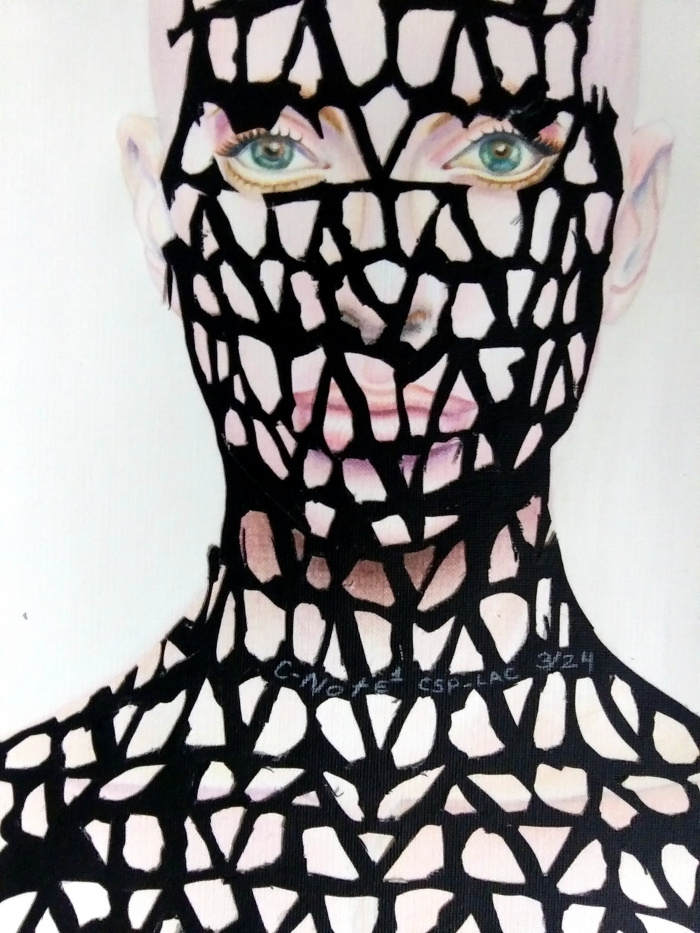

Annie Knight (Instagram/anniekknight)

Knowing she was making incredibly good money for her work, Knight knew the tax bill wouldn’t make for nice reading when it came to the cut taken by the taxman.

And despite putting aside 50 percent of her income for the entire year, under the assumption she’d be in the highest tax bracket there is in Australia, she was still shocked at the final bill.

“I put away 50 percent of my earnings into a separate account for tax, and then when tax time rolls around, if I have extra money in there, I just transfer it back to myself and pay the tax bill,” she told news.com.au.

Annie travels the world and does pretty much whatever she wants due to zero money worries (Instagram/anniekknight)

But when a bill for $405,000 (£211,610) comes your way at the end of the year, you can’t help but wince at having to hand that over in one go.

She said: “It sucks that I could literally buy a house with that money, but also, I get we all have to pay our taxes.

“I just wish we didn’t get punished for earning more money than other people. I think the highest tax bracket should be 30 percent for individuals.”

She added: “I’m really good with my money and taxes and had been putting away 50 percent of my earnings for tax so the tax bill was actually way lower than I thought it would be.

“I actually transferred myself back about $100k from my tax account, which was a nice little end-of-financial-year present to myself.”

Despite having to pay the monster tax bill, Knight says she’s exactly where she needs to be as she never has to stress about money.

She knows how lucky she is, saying it helps ‘contribute to a happier life’.

This post was originally published on this site be sure to check out more of their content.